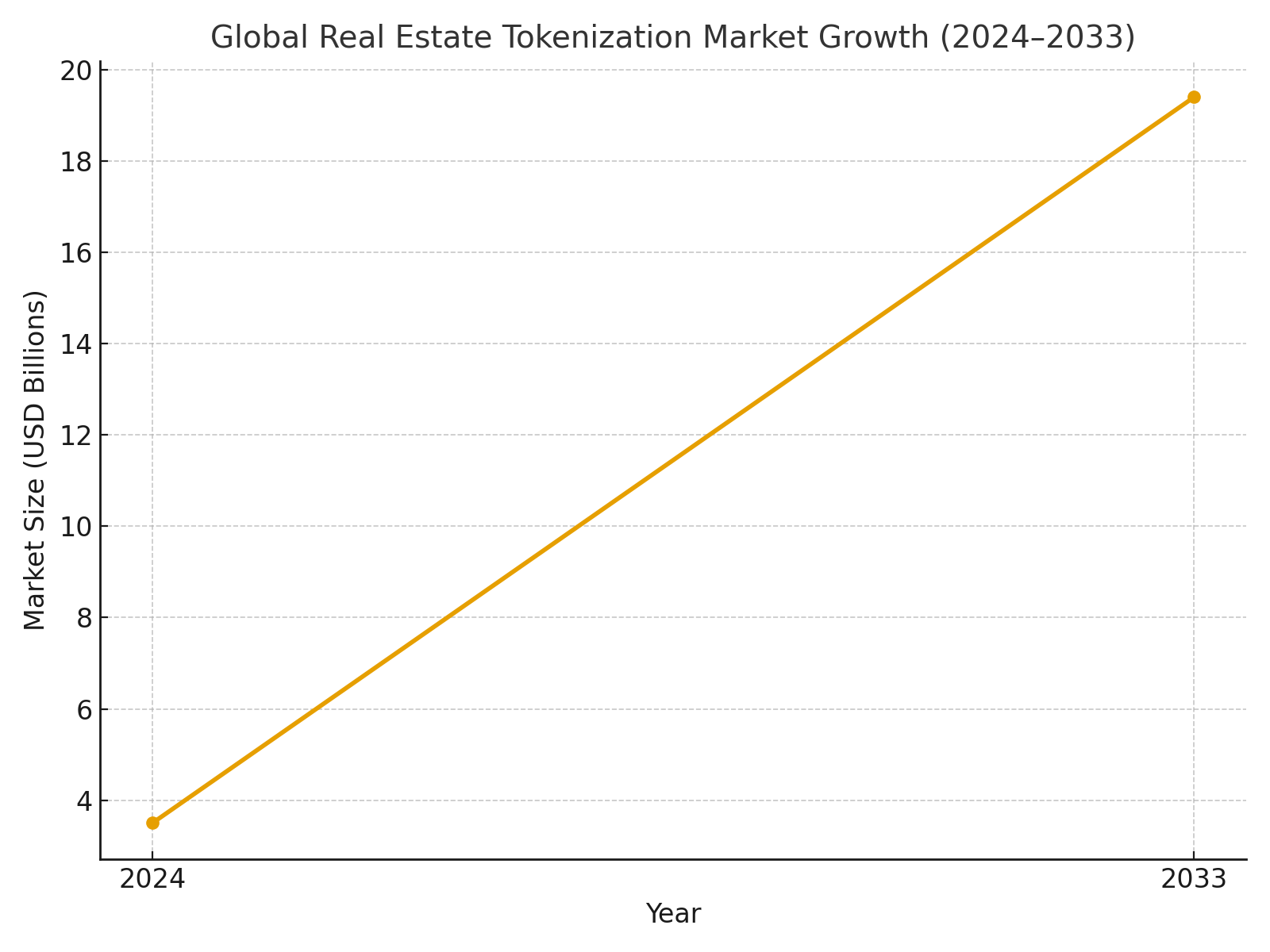

The global real estate tokenization market was valued at USD 3.5 billion in 2024 and is forecast to grow to USD 19.4 billion by 2033, reflecting a CAGR of around 21%. This sharp increase highlights how smart contracts, stronger regulations such as MiCA, and the rise of fractional ownership are making tokenized property investments more accessible, liquid and transparent for both retail and institutional investors.

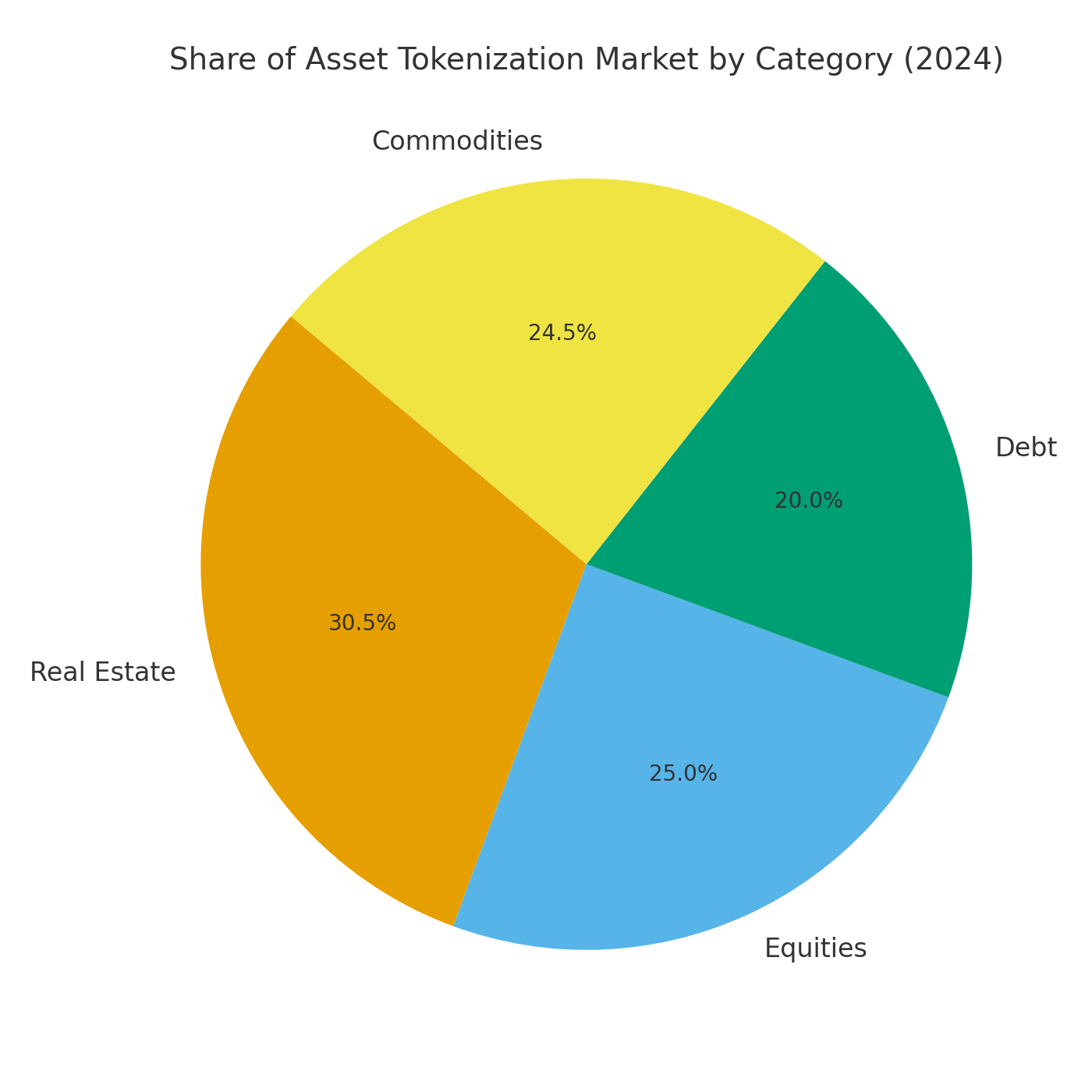

In 2024, real estate accounted for about 30.5% of the global asset tokenization market, ahead of equities, debt and commodities. This confirms that real estate tokenization is not just a concept but the largest and fastest-growing segment of tokenized real-world assets. Stronger legal frameworks like MiCA and the efficiency of smart contracts are driving adoption, with investors increasingly drawn to the liquidity and accessibility of fractional property ownership.

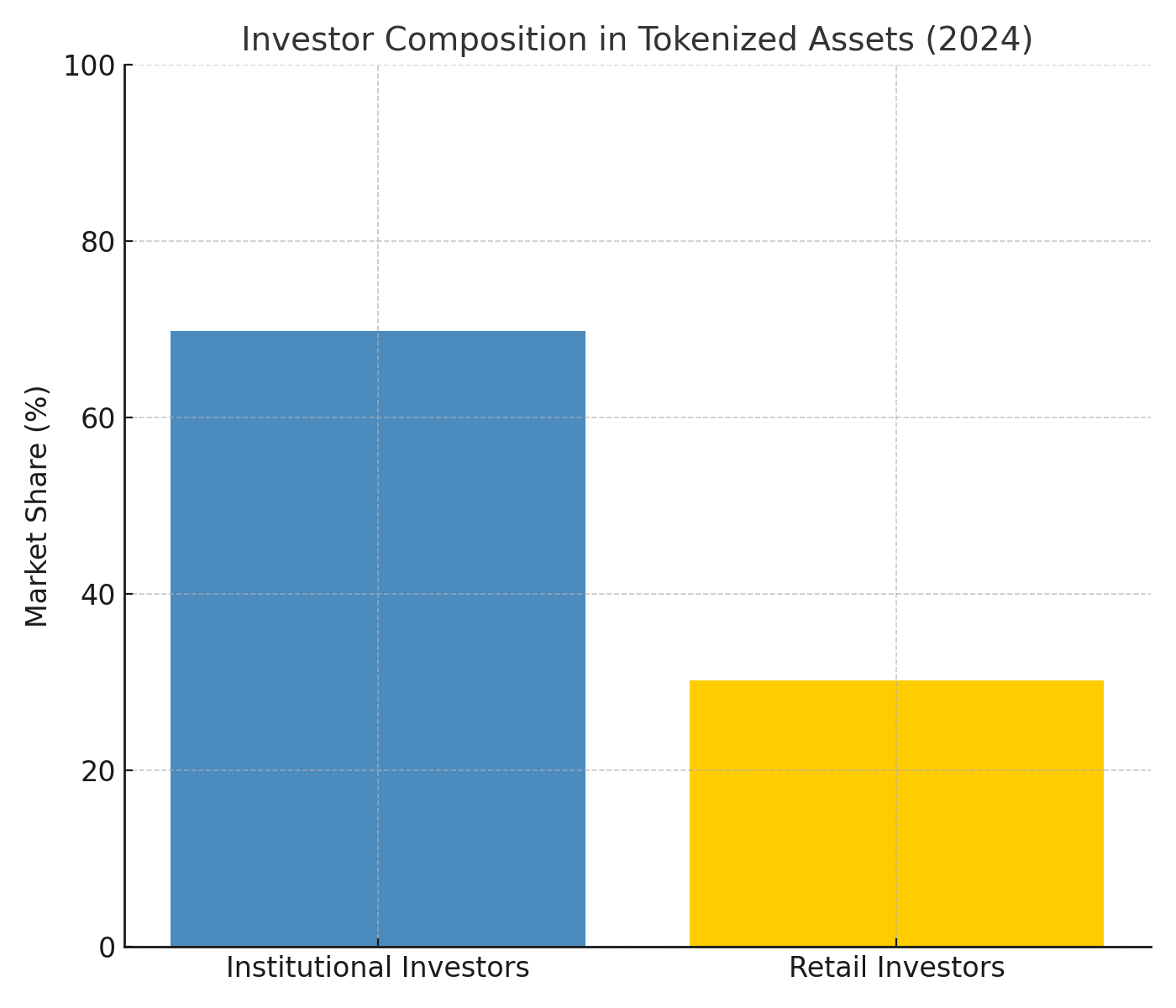

In 2024, institutional investors held nearly 70% of all tokenized assets, while retail investors accounted for just over 30%. This shows that tokenized real estate is already attracting significant institutional capital, validating it as a trusted investment class. With smart contracts ensuring compliance and MiCA regulations improving clarity, the share of retail investors is also expected to grow as fractional ownership becomes mainstream.

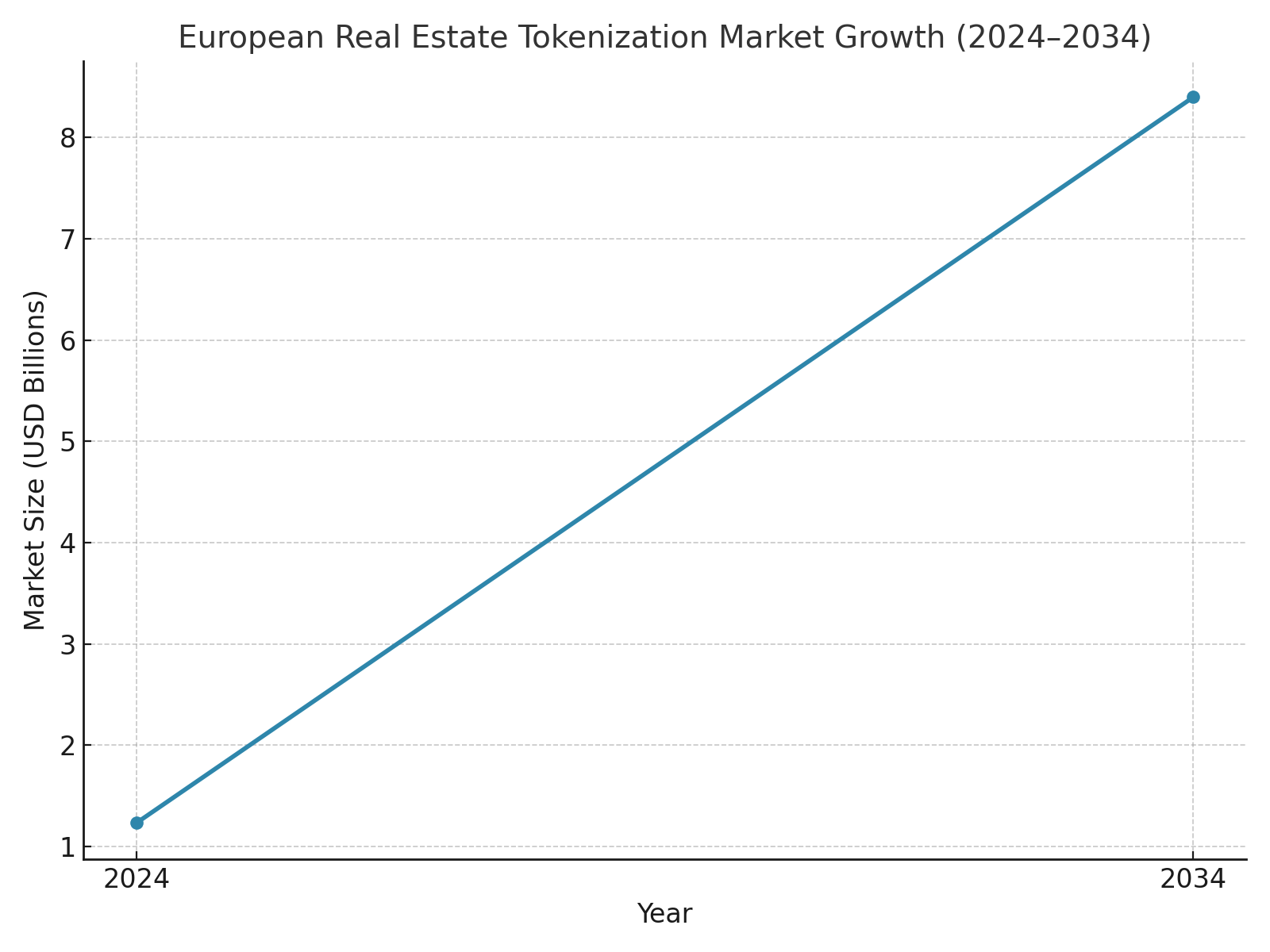

The European real estate tokenization market was valued at just USD 1.23 billion in 2024, but is forecast to expand to over USD 8.4 billion by 2034. This rapid growth reflects how fractional ownership, smart contracts, and new regulations like MiCA are reshaping property investment across Europe. The data confirms that tokenized real estate is moving from niche pilots to mainstream adoption, especially in high-demand markets such as London and major EU cities.

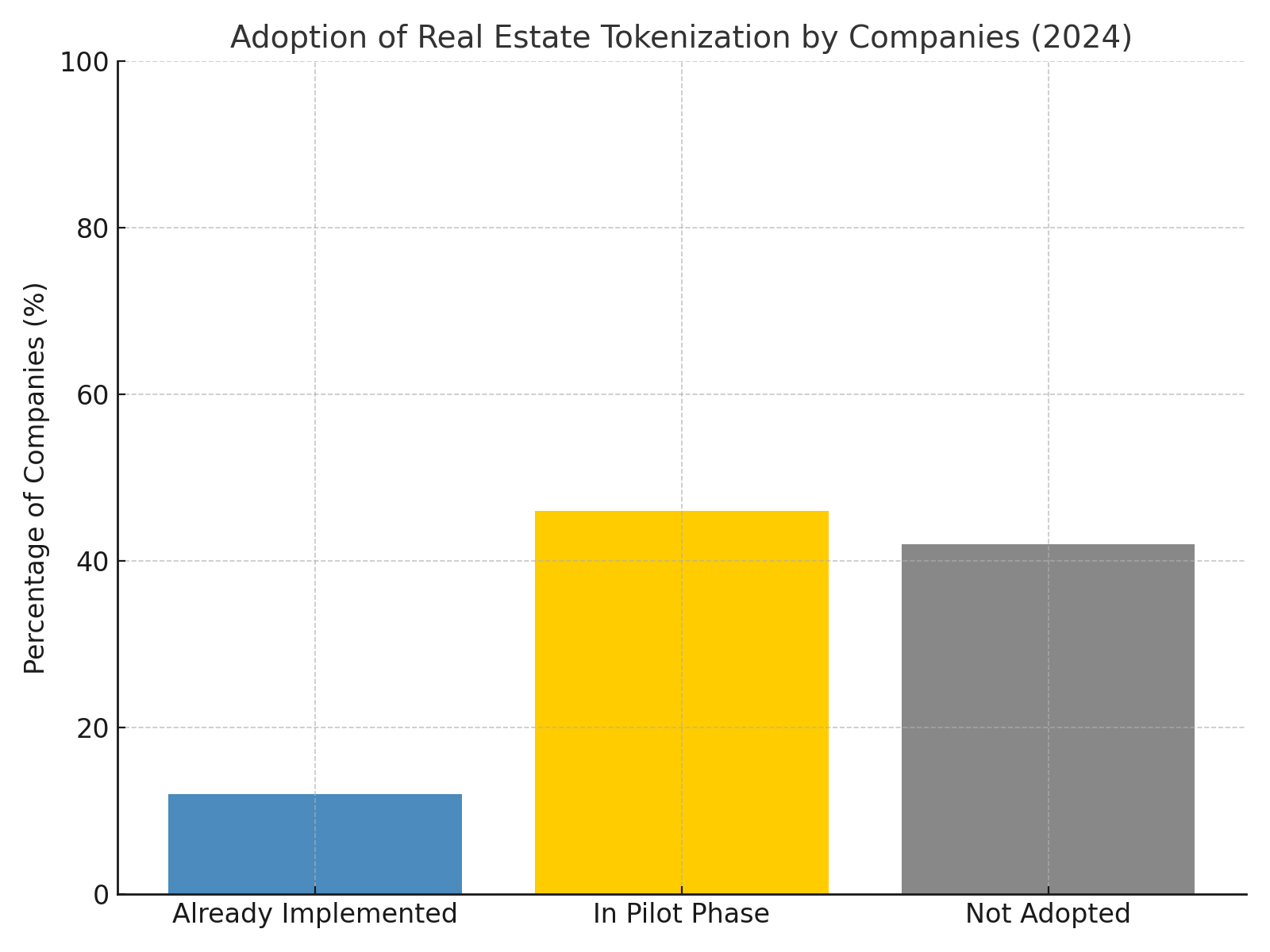

By 2024, around 12% of global real estate companies had already implemented tokenization, while another 46% were running pilot projects. This shows that adoption is no longer theoretical: nearly six in ten firms are actively testing or using smart contracts, fractional ownership models, and compliance-ready frameworks such as MiCA. The figures underline that tokenized real estate is moving quickly towards mainstream practice, reshaping how property markets operate worldwide.

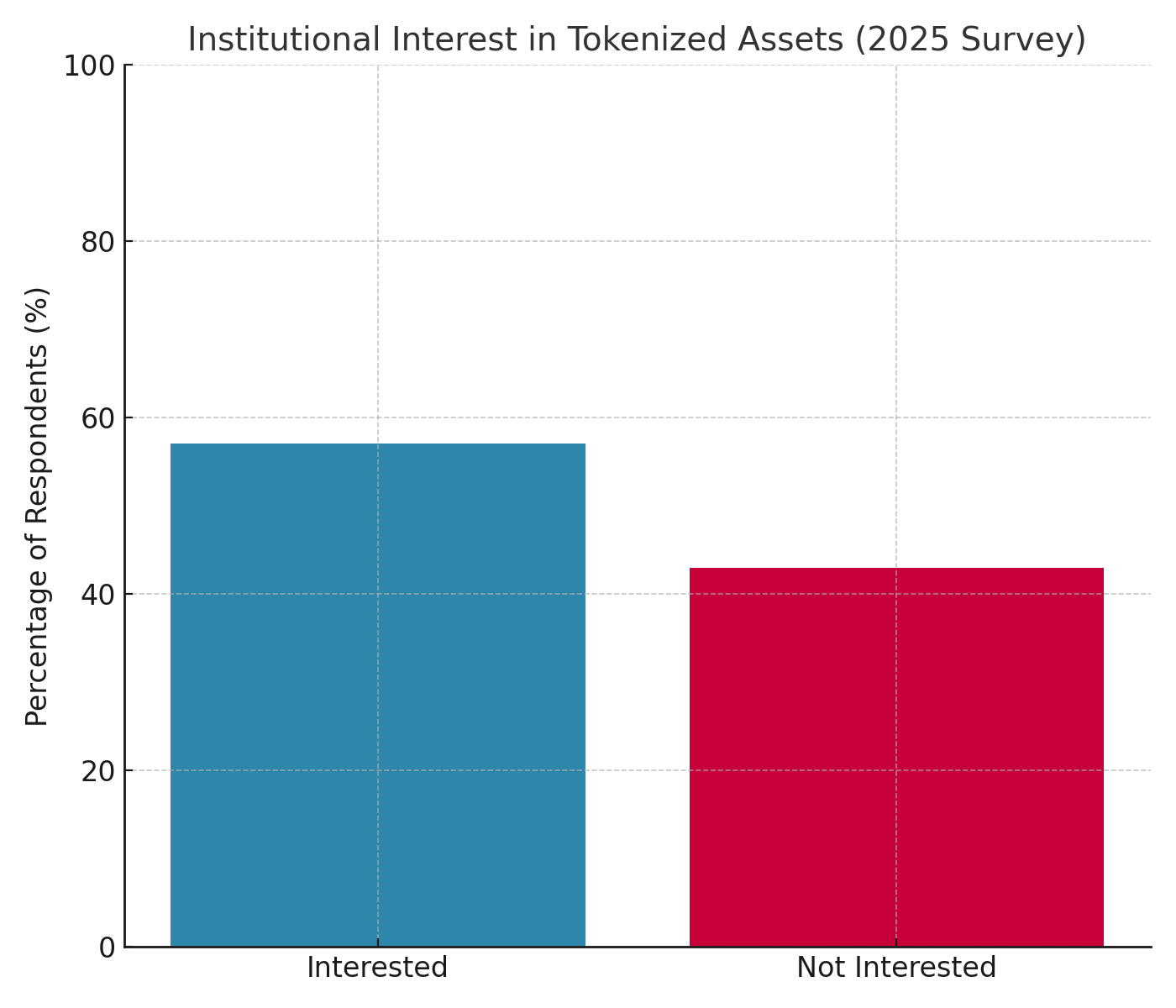

A 2025 EY survey revealed that about 57% of institutional investors are interested in allocating capital to tokenized assets, including real estate tokenization. This trend confirms that large-scale players see tokenised property as a credible, regulated alternative to traditional markets. With smart contracts reducing costs and MiCA regulations providing legal clarity, institutional demand is set to accelerate adoption and bring even more liquidity into tokenised property markets.

Want the full story? Read our in-depth article “Real Estate Tokenization & Smart Contracts: How Regulations Like MiCA Are Shaping the Future of Property Investment” to understand what these numbers mean for buyers, investors and residents.

Sources & References

- Global Real Estate Tokenization Market Growth (2024–2033)

Custom Market Insights (2024). Global Real Estate Tokenization Market Size, Trends and Insights.

Link - Share of Asset Tokenization Market by Category (2024)

Mordor Intelligence (2024). Asset Tokenization Market – Share, Size & Growth.

Link - Investor Composition in Tokenized Assets (2024)

Mordor Intelligence (2024). Asset Tokenization Market – Share, Size & Growth.

Link - European Real Estate Tokenization Market Growth (2024–2034)

Antier Solutions (2024). Real-World Asset Tokenization in Europe: Country-by-Country Analysis.

Link - Adoption of Real Estate Tokenization by Companies (2024)

CoinLaw (2024). Asset Tokenization Statistics: Market Size & Trends.

Link - Institutional Interest in Tokenized Assets (2025 Survey)

EY (2025). EY Global Institutional Investor Digital Assets Survey.

PDF Link

Discussion