Buying your first home, especially in a competitive market like London or Dubai, can feel overwhelming.

Should you choose a new build? What area fits your budget and future goals? How do you avoid common mistakes?

Here’s the truth: there is no one-size-fits-all answer, but there is a smarter way to get started.

At Entralon, we listen to your goals and give you honest, unbiased property advice tailored to your needs, with no pressure and no cost. We show you the entire market, not just promoted listings, so you can make the right choice with full confidence.

Let us help you find the right new build property in London or Dubai, no strings attached.

Why Is 2025 the Best Year to Buy a New Build Home in London or Dubai as a First-Time Buyer?

Because market conditions are aligning in your favour, with rising rents, attractive mortgage options, and developer incentives, making 2025 an ideal entry point.

In both London and Dubai, real estate markets are evolving rapidly. For first-time buyers, this year offers a rare combination of opportunities: new build inventories are still available, but demand is climbing, especially for well-located properties. In London, rising rental costs are now exceeding monthly mortgage payments in many boroughs, while Dubai offers long-term visa benefits for property buyers, particularly those investing in off-plan developments.

Add to that historically low interest rates (in some cases for fixed-rate mortgages), limited new supply due to construction delays, and attractive payment plans, and 2025 becomes a window that may not last long.

Whether you’re looking for a modern apartment in Zone 2 London or a waterfront residence in Dubai Marina, this could be the smartest time to act.

Dubai Land Department data shows that 64% of 2025 Q1 transactions were off-plan sales, driven by EU-based buyers.

Can Foreigners or Expats Buy Property in London or Dubai in 2025?

Yes, both cities allow foreign property ownership, but the rules and benefits differ significantly.

In London, foreigners, including EU and MENA nationals, can freely buy property, including new-build homes, without any residency requirements. However, they may face additional taxes such as the 2% non-resident Stamp Duty surcharge. Financing is also possible, though overseas buyers may need a larger deposit and meet specific bank criteria.

In contrast, Dubai not only allows foreigners to purchase freehold properties in designated areas, but also offers long-term residency visas for eligible investments. As of 2025, non-residents who purchase property worth AED 2 million or more can qualify for the 10-year Golden Visa, making Dubai a particularly attractive market for EU-based first-time buyers.

Whether you’re a first-time buyer from Europe or the Middle East, both London and Dubai offer clear and increasingly popular pathways to property ownership and long-term value.

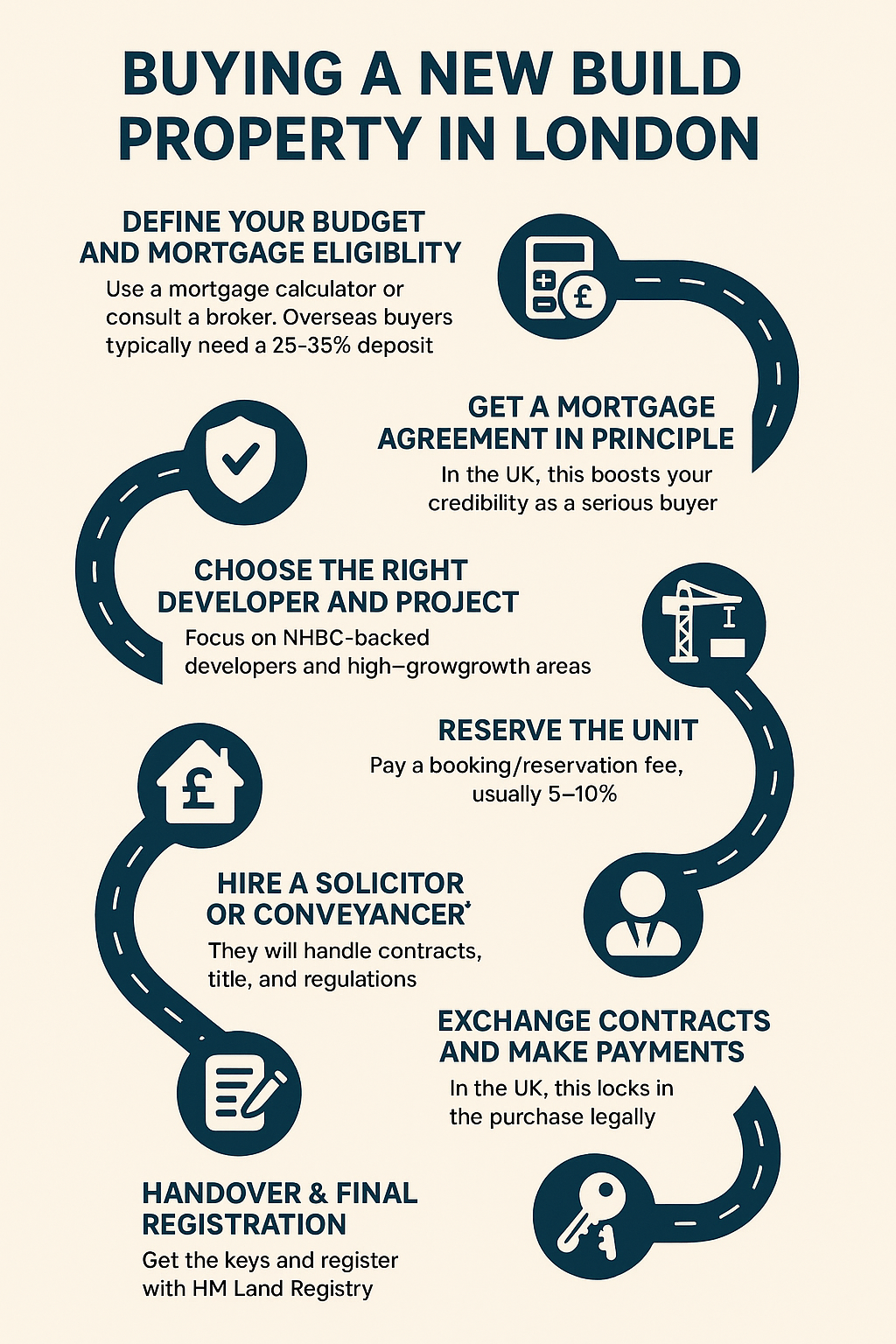

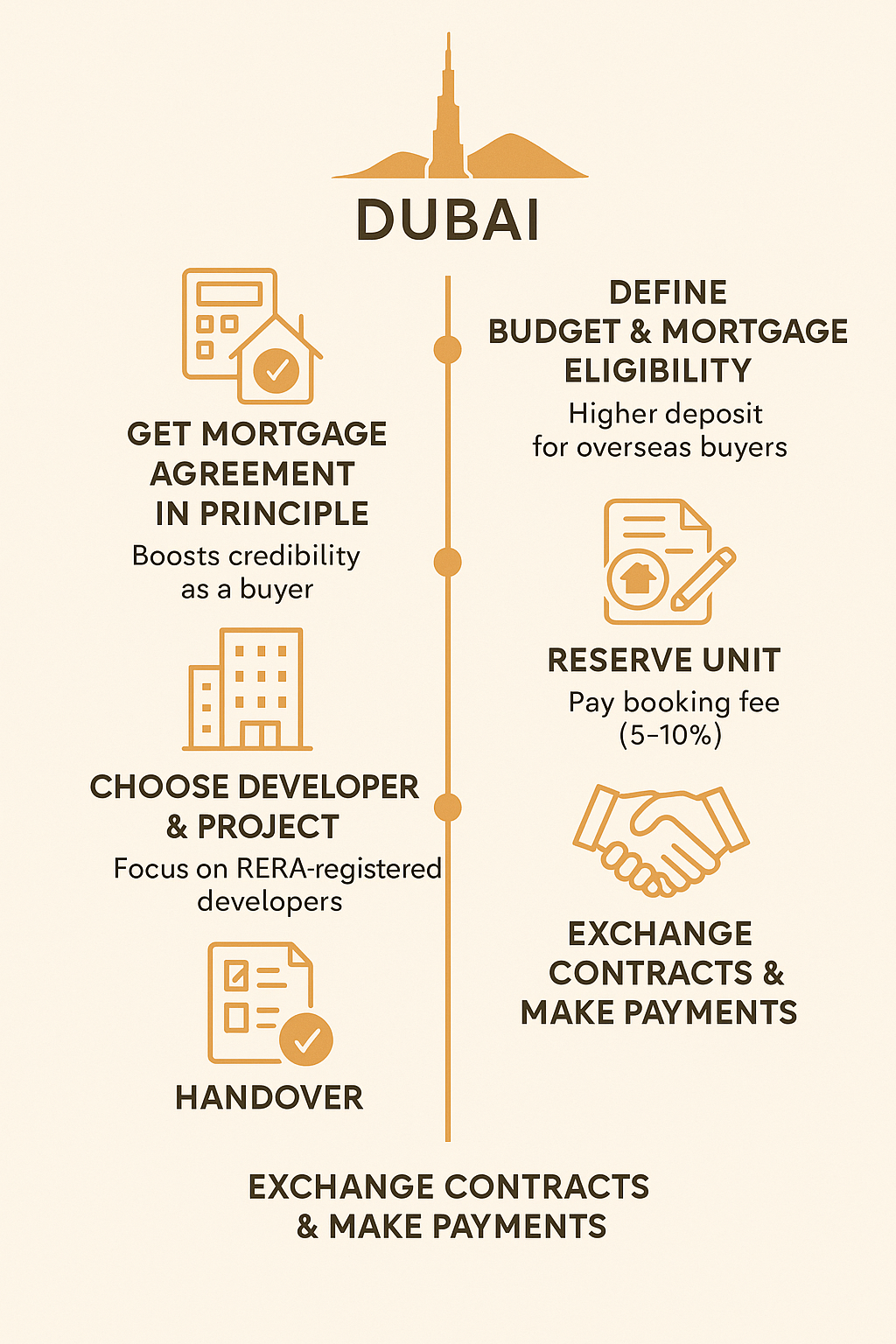

How Can You Buy a New Build or Off-Plan Property in London or Dubai as an International Buyer?

Start by getting your finances ready, then follow a clear legal and purchase process tailored to new build and off-plan homes.

Whether you’re buying in London or Dubai, the process for purchasing a new build property or an off-plan development follows a structured path, but there are key differences, especially for international buyers.

Step-by-Step Guide:

- Define Your Budget and Mortgage Eligibility

- Use a mortgage calculator or consult a broker.

- For overseas buyers, expect higher deposits (typically 25–35%).

- In Dubai, developers may offer post-handover payment plans, reducing the need for traditional mortgages.

- Get a Mortgage Agreement in Principle (AIP)

- In the UK, this boosts your credibility as a serious buyer.

- In Dubai, some banks lend to non-residents, but many off-plan buyers pay in instalments directly to the developer.

- Choose the Right Developer and Project

- Look for RERA-registered developers in Dubai and NHBC-backed developers in the UK.

- Focus on areas with high rental yields or strong capital growth potential.

- Reserve the Unit

- Pay a booking/reservation fee (usually 5–10%).

- Review all payment milestones, especially for under-construction properties.

- Hire a Solicitor or Conveyancer

- They will manage contracts, title verification, and local regulations.

- In Dubai, they also coordinate with the Dubai Land Department (DLD).

- Exchange Contracts and Make Payments

- In the UK, this locks in the purchase legally.

- In Dubai, buyers receive a Sales and Purchase Agreement (SPA), often before construction is completed.

- Handover & Final Registration

- UK buyers get keys after completion and legal registration with HM Land Registry.

- Dubai buyers collect keys once the project is handed over and registered via the DLD.

Want a complete, unbiased view of the property market?

At Entralon, we show you the full range of available properties in both London and Dubai, with no paid promotions, no hidden listings. Just a transparent, full-market overview so you can make the right decision.

Explore All New Build Properties in London

Explore All New Build Properties in Dubai

No matter where you’re based, we’re here to help you navigate every step, free and without pressure.

How Much Budget Do You Need to Buy Your First New Build Home in London or Dubai?

Expect higher upfront costs in London due to taxes, while Dubai offers flexible payment plans and developer incentives.

When buying your first property, budgeting goes beyond just the purchase price. In London, first-time buyers must account for:

- Deposit: typically 5–20% of the property price

- Stamp Duty Land Tax (SDLT): 0–5% for residents; +2% surcharge for non-residents

- Legal fees & surveys: £1,000–£2,500 depending on complexity

- Mortgage-related costs: broker fees, valuation, insurance

In contrast, Dubai offers more flexibility for international buyers:

- Deposit: often 10–20% at reservation

- Stamp Duty: fixed at 4% DLD registration fee (shared in some cases by developer)

- Developer incentives: include free DLD fee, waived service charges, or furnished units

- Payment plans: e.g., 60/40 or 50/50 split across construction milestones and post-handover

If you’re a first-time buyer comparing London vs Dubai, the key difference lies in immediate liquidity vs long-term flexibility. Dubai often reduces the financial burden upfront, while London offers a more traditional mortgage structure, but with tax overhead.

What Are the Best Areas to Buy a New Build Property in London or Dubai in 2025?

For first-time buyers and investors alike, choosing the right location can define long-term value, and both cities offer prime zones with strong potential.

In London, regeneration areas and riverside zones are attracting increasing interest from buyers of new-build homes. Top areas include:

- Nine Elms: Home to the new US Embassy and Battersea Power Station, offering high-rise living and riverside luxury

- Canary Wharf: A hub for professionals, with strong rental yields and sleek modern developments

- Barking & Dagenham: One of London’s most affordable new build zones, with high growth projections

In Dubai, popular freehold districts for international buyers include:

- Business Bay: Central, cosmopolitan, and minutes from Downtown

- Jumeirah Village Circle (JVC): A favourite for families and mid-range investors seeking value and space

- Dubai Hills Estate: A master-planned luxury community with schools, parks, and a golf course, ideal for long-term living

Tip: If you’re buying as a first-time buyer or expat investor, align your area choice with your goal: rental income, capital appreciation, or residency eligibility.

Final Thoughts

Navigating the property markets of London and Dubai can be complex, especially for first-time buyers and international investors. Entralon simplifies the journey by offering:

- Honest, Full-Market Insights: We show you the entire landscape without paid placements or hidden listings.

- Personalised Assistance: Our advisors tailor recommendations after understanding your unique goals, timeline, and financial situation.

- AI-Powered Market Data: Our property suggestions are backed by smart data analysis, giving you the clarity and confidence to make the right move.

Want to explore the full property market, completely unbiased and aligned with your goals?

Visit us at Entralon.com

FAQ

1. Can foreigners buy property in London and Dubai?

Yes. In London, foreign nationals can purchase property without restrictions but may face additional stamp duty charges. In Dubai, foreigners can buy in designated freehold areas, with opportunities to obtain residency visas for qualifying investments.

2. What are the upfront costs involved in purchasing property?

- London: Expect to pay a deposit (typically 5–20%), stamp duty (varies based on property price and residency status), legal fees, and survey costs.

- Dubai: Costs include a 4% Dubai Land Department (DLD) fee, agency commissions, and potential developer fees.

3. Are there mortgage options for international buyers?

Yes. In London, many banks offer mortgages to non-residents, though terms may vary. In Dubai, non-residents can obtain mortgages, often covering up to 50–60% of the property’s value, depending on the lender.

4. What is the process of buying off-plan properties?

Purchasing off-plan involves buying a property before it’s completed. Typically, buyers pay a reservation fee, followed by instalment payments during construction. It’s crucial to research the developer’s reputation and understand the payment schedule.

5. Does buying property in Dubai grant residency?

Investing in property worth AED 2 million or more in Dubai can qualify you for a 10-year Golden Visa, offering long-term residency benefits.

Discussion