How Smart Refurbishment Can Increase Investment Returns in Older Buildings

-

Experienced fenestration professional across the UK and Australia, delivering compliant, high-performance façade and glazing solutions. Advocate for best practice and zero-carbon strategies aligned with sustainability-led systems.

Experienced fenestration professional across the UK and Australia, delivering compliant, high-performance façade and glazing solutions. Advocate for best practice and zero-carbon strategies aligned with sustainability-led systems. - •

- •

- 5 min read

Read Next

What Tokenisation Really Fixes in Rental Markets And Why Capital Should Care

Dr Farid Zadeh Bagheri is an entrepreneur and strategist focused on redefining access in real estate through structural insight, technology, and global investment experience.

Dubai and the Practical Role of AI in Real Estate Decision-Making

Svetlana Fedosova is the Founder of Entralon Club and a real estate strategist focused on decision architecture, governance, and institutional trust across global property markets.

When Gen Z Values “Vibe” Over Size: What Developers Must Rethink

A real estate market analyst exploring generational behavior, digital influence, and capital strategy in global property markets.

How Tokenised Markets Reshape the Agent Economy: From Transaction Closers to Market Stewards

Dr Farid Zadeh Bagheri is an entrepreneur and strategist focused on redefining access in real estate through structural insight, technology, and global investment experience.

Gaming the System: What China’s Housing Market Reveals About Regulatory Design

Low Tuck Kwong Distinguished Professor at NUS; ex-Georgetown and Chicago Fed; author of Kiasunomics; leading researcher on household finance and real estate.

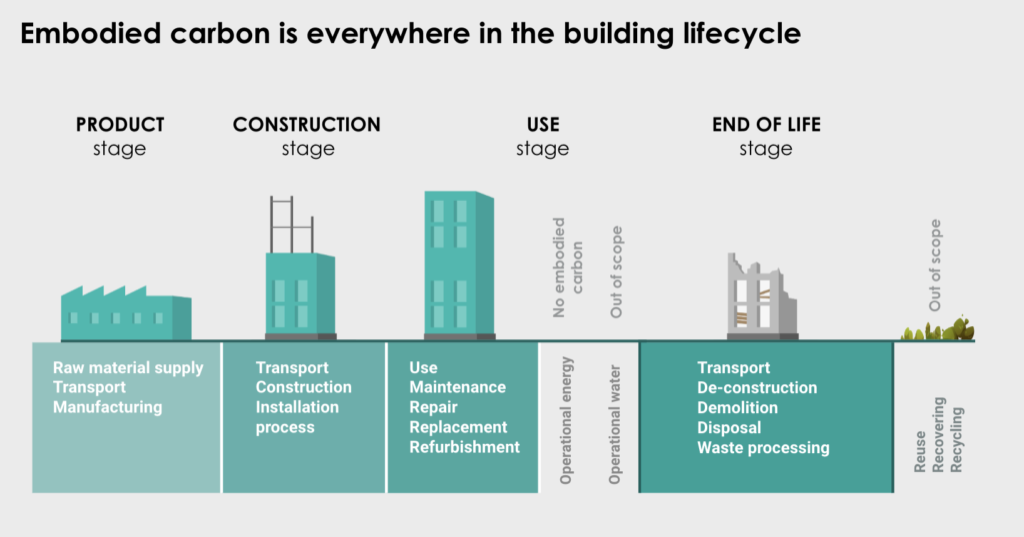

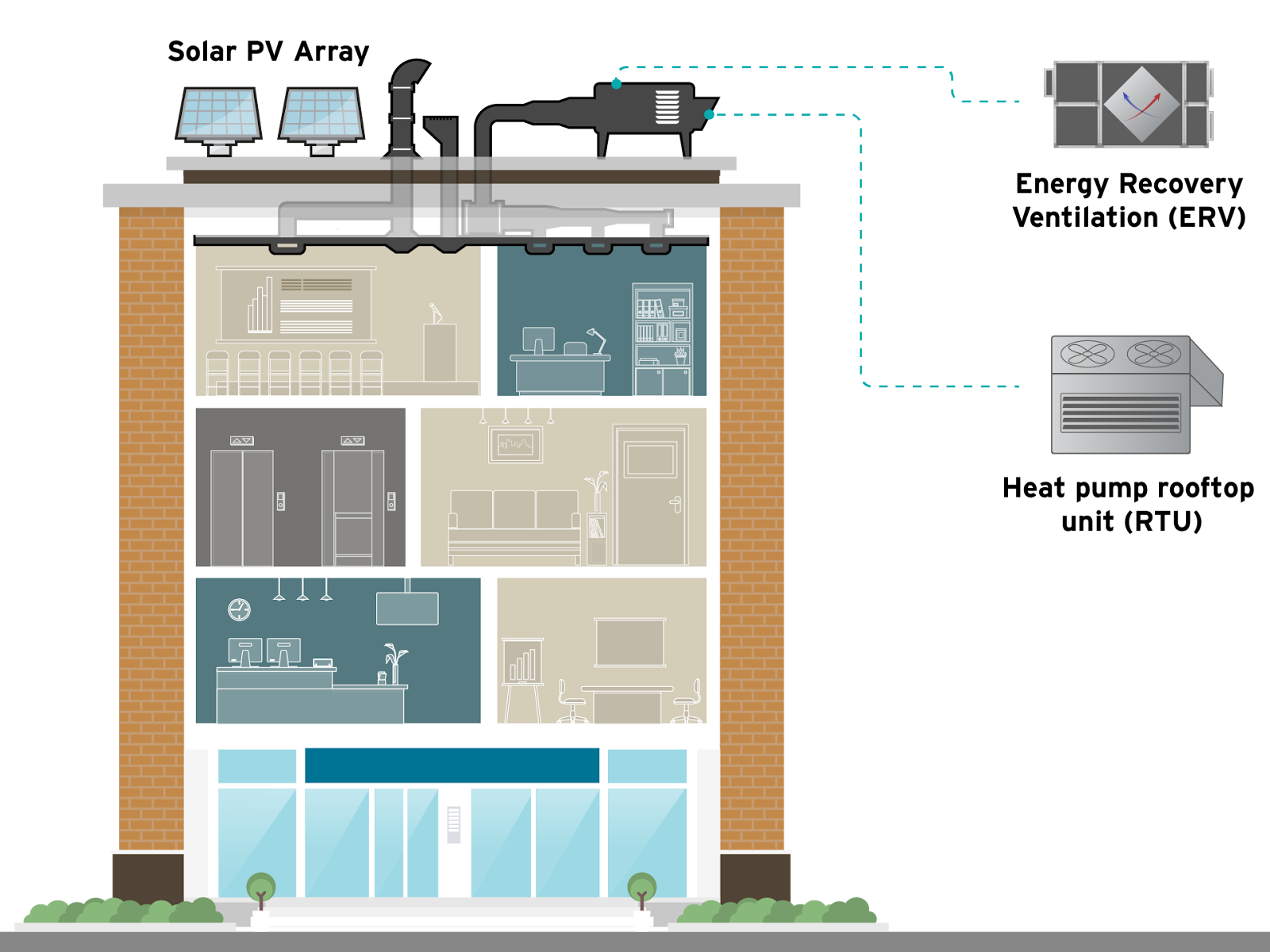

When Buildings Are Judged Over 30 Years, Design Alone Is No Longer Enough

Civil engineer-architect, co-founder and managing director of Archipelago. Specialised in research-driven architecture for living, care, work and learning, with a focus on user experience, sustainability and circular building economics.

Affordable Housing at a Turning Point: A Southern European Perspective from Greece

Anna Chalkiadaki, CFO & Board Executive at DIMAND S.A., leads finance, capital planning and investments. 20+ yrs RE; ex Deputy CFO Prodea; NBG Pangaea founder; Grivalia ATHEX listing; ex Deloitte.

Subscribe to Newsletter

Join me on this exciting journey as we explore the boundless world of web design together.