Property in Dubai, and is it still worth it in late 2025?

For Iranian investors seeking stability, fast-track migration, and strong capital growth, Dubai offers a rare combination of speed, security, and yield. New build properties, particularly off-plan and recently completed units (Off-plan refers to properties still under construction, while recently completed units have just received their handover certificate and can be registered immediately), enable property-backed residency with processing times as short as 4 to 6 weeks for eligible buyers. Compared to countries with 12–18-month visa queues, Dubai stands out for both migration efficiency and proximity.

This report explores why, in 2025, Dubai has become the most practical path to investment and relocation for Iranians.

Dubai’s Property Market in 2025: A Surge in New Build Confidence

Dubai’s real estate sector in 2025 continues to attract attention, not just for its luxury appeal but for its consistent growth, investor-friendly policies, and resilient fundamentals. New-build apartments, especially off-plan projects, are outperforming expectations, drawing both lifestyle buyers and yield-driven investors from around the globe.

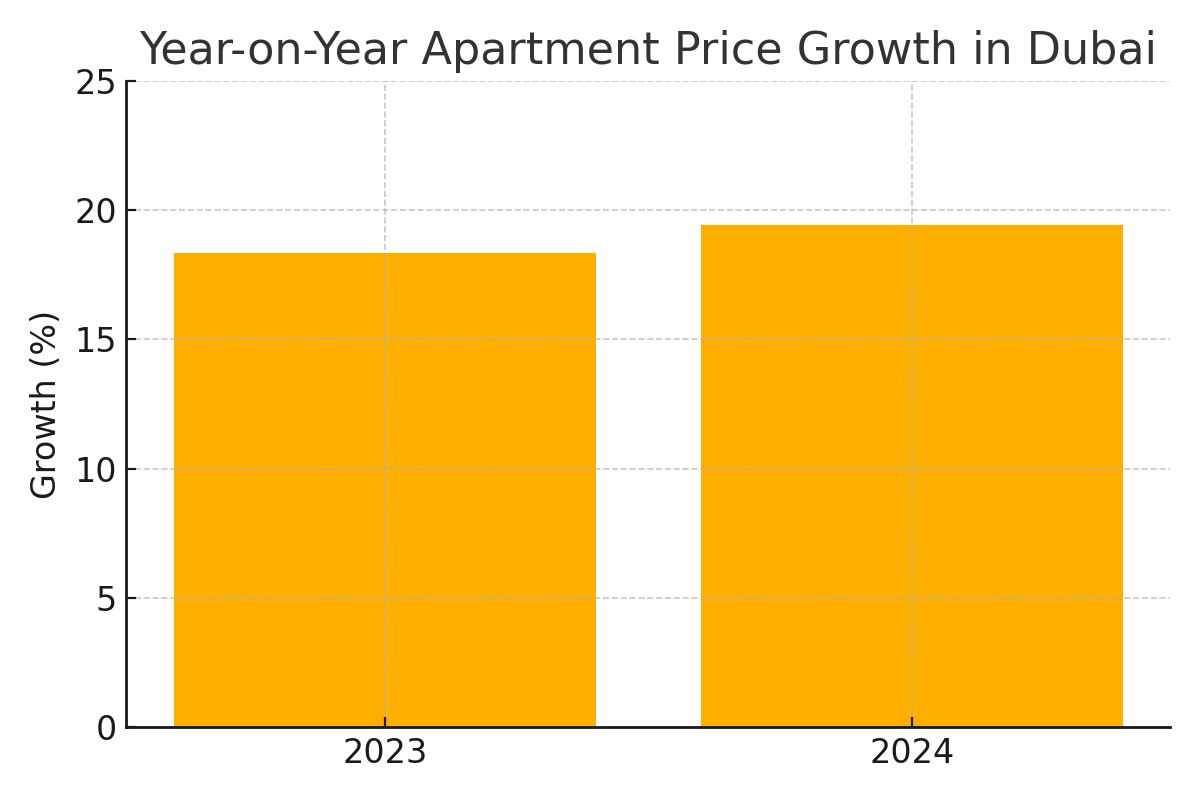

According to CBRE’s UAE Real Estate Market Review (Q1 2024), average apartment prices rose by 20.4% year-on-year to March 2024, continuing into Q4 2024 with a 1.94% quarterly increase. The average apartment price reached AED 1.4 million (£294,000) by December 2024, with prime districts such as Downtown Dubai, Dubai Marina, and Palm Jumeirah leading the surge. In the primary market, prices hit AED 1,558 per sq ft (£327), compared to AED 1,332 (£280) in the secondary market.

For example, a 1-bedroom apartment in Dubai Marina, measuring 750 sq ft, would cost approximately AED 1.17 million in the primary market.

Dubai’s apartment prices have shown back-to-back annual growth, reaching 19.43% in 2024, signalling a resilient market even amid global headwinds. (Source: Reidin, Nov 2024)

Transaction activity also broke records. The Dubai Land Department (DLD) logged 20,500 property transactions in December 2024 alone, a 38% increase compared to December 2023. Apartments dominated the market with 16,200 transactions, amounting to AED 28 billion in value. Total sales for December reached AED 50 billion, up 22% year-on-year.

Off-plan sales remain the cornerstone of this momentum. In 2024 alone, these sales jumped 25%, representing 59% of April 2025 transactions. Developers such as DAMAC and Emaar have capitalised on this trend by prioritising flexible payment plans and early handovers in areas such as Jumeirah Village Circle (JVC) and Mohammed Bin Rashid City (MBR).

Off-plan properties accounted for 59% of all apartment sales in April 2025, highlighting buyer appetite for flexible payment schemes and early investment entry points.

Key Highlights for 2025 (at a glance):

- +19.43% YoY growth in apartment prices (Reidin, Nov 2024)→ This marks the second consecutive year of double-digit growth, signalling strong buyer confidence despite global uncertainties.

- AED 50 billion total sales volume in Dec 2024 (DLD)→ A record-breaking month reflecting sustained liquidity and heightened activity in the residential sector.

- Off-plan dominance: 59% of April 2025 sales→ Indicates strong investor appetite for flexible payment plans and capital appreciation potential.

- Top areas: JVC, MBR City, Dubai Creek Harbour→ These zones combine affordability, infrastructure expansion, and high off-plan handover activity.

- Rental yields: up to 7%, no capital gains tax→ Competitive returns compared to London (2.4%) or Berlin (3.1%), with favourable tax treatment for overseas buyers.

JVC, MBR City and Dubai Creek Harbour have emerged as leading zones for off-plan transactions in 2025, driven by infrastructure growth and developer incentives.

Why This Matters for Investors

Dubai’s property market is not only growing, it’s maturing. The combination of rising prices, resilient transaction volumes, and strong rental yields reinforces confidence in the market. Investors benefit from:

- Strong historical growth in prime and mid-market areas

- Transparent transaction data (via DLD, CBRE, Property Monitor)

- Government-backed infrastructure, legal clarity, and visa pathways

As 2025 progresses, new build apartments in Dubai offer more than just bricks and mortar. They provide a gateway to regional security, lifestyle mobility, and financial diversification.

For many Iranian buyers, investing in Dubai is not just a financial hedge; it’s a strategic move to secure family mobility, access regional business hubs, and gain residency in a legally and economically stable jurisdiction.

Want full visibility before you decide?

Explore every verified off-plan and completed project in Dubai; all in one place, with nothing filtered or hidden.

View the complete property listings in Dubai.

Why Dubai Makes Strategic Sense for Iranian Investors in 2025

The recent 12-day escalation between Iran and Israel has once again underlined the need for stability, mobility, and financial flexibility among Iranians, especially those with cross-border assets or regional exposure. Even for individuals not directly affected, the psychological toll of geopolitical volatility has been profound: stress, uncertainty, and an urgent need for contingency planning have entered everyday conversations among investors and entrepreneurs in Tehran, Isfahan, and beyond.

Dubai, due to its proximity, neutrality, and infrastructure, has emerged as a natural choice for those seeking a fast, reliable second base. Whether through direct flight corridors or maritime access, Iranian nationals see Dubai not just as a destination, but as an emergency exit strategy. Real estate, particularly in the off-plan segment, is now more than an investment vehicle; it is a form of protection.

Why Buying Property in Dubai Makes Sense Right Now

- Fast-track migration: Property investment can unlock residency within 4 to 6 weeks for qualifying buyers.

- Geographic proximity: Less than 2 hours from southern Iran by air or sea, with regular flights to all major Iranian cities.

- Strong rental yields: 7% average ROI, compared to 2.4% in London and under 3.1% in Berlin (ValuStrat, 2024).

- No capital gains tax: Investors retain full upside potential with no taxation on appreciation.

- Mortgage access for non-residents: Banks such as Emirates NBD and Mashreq offer financing up to 50–70% LTV, including for Iranian passport holders with overseas bank accounts.

- Off-plan entry points: High-quality developments in areas such as JVC and Dubai South start from under AED 750,000.

Confidence Backed by Policy and Demand

According to DAMAC Properties, over 100,000 individuals have benefited from the UAE’s visa reforms, particularly the Golden Visa, many through property ownership. The government’s strategy aims to reach 4 million residents by 2026 and raise homeownership to 33% by 2033, supported by relaxed mortgage rules and affordable housing zones.

ValuStrat data shows rents in areas such as JVC and Dubai Silicon Oasis have surged 20% year-on-year, encouraging residents to shift from renting to owning. For Iranians who need optionality, whether for relocation, asset diversification, or emergency planning, Dubai presents an accessible, efficient, and financially sound route.

How Entralon Makes Dubai Property Investment Simple for Iranians

While Dubai presents one of the most accessible routes to investment-backed migration, the process can still be intimidating, especially for first-time buyers from Iran navigating a foreign legal system, financing structure, and market culture. From misleading ads to commission-driven sales tactics, many platforms promise simplicity but deliver confusion.

Entralon was built to change that. We believe clarity and alignment matter more than marketing.

Most platforms sell properties. We build long-term plans. Our advisors are trained not only in real estate law and finance but also in a migration strategy, ensuring your investment decision matches your future life goals. Whether you’re preparing a contingency plan, seeking a fast relocation option, or just testing the waters, Entralon stands with you.

For example, if your aim is to secure a Golden Visa through a property purchase of AED 2 million+, we identify developments that meet the visa criteria, offer strong yields, and fall within your liquidity range.

Ready to get started?

You can share your investment goals and financial situation with us right now using the link below, and we’ll guide you, step by step, toward the right property and visa path.

Our advisors also speak Farsi, so feel free to reach out in the language you’re most comfortable with.

Final Thoughts

Certainty in an Uncertain World

In 2025, Iranian investors are navigating a volatile global landscape, from regional instability to economic unpredictability. In this context, Dubai emerges as a rare constant: a city offering speed, legal stability, financial returns, and lifestyle access in one coherent package.

Whether your goal is residency through property, portfolio diversification, or securing an emergency Plan B for your family, Dubai offers one of the fastest, most structured, and strategically located solutions.

And with Entralon, this journey becomes not just possible, but radically simplified. From tailored property shortlists and bank financing support to Farsi-speaking advisors and Golden Visa planning, we guide you from search to signing and beyond.

Your next chapter doesn’t begin with a risk. It begins with a choice. Let us help you make it with clarity.

FAQ

Q: How quickly can I get a visa after buying property in Dubai?

A: If the property meets the criteria (AED 750,000+), a 2-year residency visa can be issued in 4–6 weeks. AED 2M+ qualifies for a 10-year Golden Visa, renewable and covering family members.

Q: Can I get a mortgage as an Iranian national?

A: Yes. Several UAE banks offer home loans of up to 70% LTV for non-residents, including Iranian passport holders with overseas accounts. Entralon helps you assess your eligibility and documentation.

Q: What are the best areas for affordable investment in Dubai?

A: Jumeirah Village Circle (JVC), Dubai South, and Dubai Silicon Oasis offer strong yields, off-plan availability, and visa-linked developments under AED 1 million.

Q: Does Entralon charge for consultations or property viewings?

A: No. All Entralon advisory services are free for buyers, including curated property lists, viewing coordination, and documentation support.

Q: Why is Dubai safer or more stable than other migration options?

A: Dubai offers political neutrality, strong infrastructure, no personal income tax, and rapid residency pathways, ideal for investors seeking both mobility and protection.

Discussion