Editor’s Note:

This article is part of Entralon Hub’s Leadership View series, where senior contributors examine the structural forces reshaping access, participation, and long-term stability in global housing markets.

In this feature, Dr Farid Zadeh Bagheri, CEO & Founder at Open Estate, explores how tokenisation is changing real estate at the market level. Not by altering the asset itself, but by upgrading the infrastructure around it: liquidity, coordination, and the unification of fragmented systems.

For decades, real estate markets were designed around a simple assumption: assets are large, transactions are infrequent, and participants are few but well-capitalised. That structure worked when demand was local, capital was patient, and ownership moved slowly.

Today, those assumptions no longer hold.

Real estate assets have grown in value, scale, and complexity, but the market infrastructure that supports them has barely evolved. Capital still moves slowly. Ownership remains rigid. Participation is tightly constrained. What once felt like stability now functions as friction.

The result is not a broken market, but a ceiling.

Real estate continues to perform as an asset class, prices hold, projects get built, transactions close, yet participation struggles to expand alongside asset growth. As values rise, the market becomes harder to enter, slower to navigate, and more dependent on a narrow set of actors who already control capital, access, or balance-sheet capacity.

This creates a quiet imbalance.

The market looks active, but it is increasingly exclusive. It produces assets efficiently, but distributes opportunity poorly. Growth at the asset level no longer translates into renewal at the participant level.

Crucially, this is not a cyclical problem. It is not explained by interest rates alone, sentiment shifts, or temporary slowdowns. Even when demand exists and capital is available in aggregate, the system struggles to coordinate it efficiently. Capital waits. Transactions queue. Participants fall out of sync.

In other words, the market still works, just not at the scale or speed its own growth now requires.

That is why real estate needs change. Not because the assets are flawed, but because the structure governing access, movement, and participation was never designed to scale with modern capital dynamics.

💡

Investor Lens:

Markets stop scaling when participation cannot grow as fast as asset value.

Insights from Those Who Shape the Market

Subscribe to get first access to exclusive interviews and perspectives from top industry voices.

No spam. Unsubscribe anytime.

If real estate’s core challenge were asset quality or demand, innovation alone might be enough. But as the previous section showed, the issue runs deeper. The market does not fail because people want fewer buildings. It struggles because the systems that move capital, ownership, and information were built for a slower, smaller world.

This is where tokenisation enters the conversation, not as a promise of disruption, but as a tool of structural adjustment.

At its core, tokenisation does not change what real estate is. The asset remains physical. Risk does not disappear. Location, quality, and cash flows still matter. Credit discipline, due diligence, and valuation frameworks remain intact.

What changes is how the market coordinates around those fundamentals.

Tokenisation introduces a more flexible representation of ownership and exposure. Instead of requiring capital to move in large, infrequent blocks, it allows participation to be distributed, transferred, and reassembled with far less friction. The value lies not in novelty, but in alignment: aligning asset scale with capital movement, and ownership structures with modern participation patterns.

Seen through this lens, tokenisation is closer to infrastructure than innovation. It upgrades the market’s plumbing rather than redesigning the building.

Importantly, tools do not create outcomes on their own. Without addressing fragmentation, poor coordination, and slow settlement, tokenisation would remain cosmetic. But when applied to the right pressure points (ownership records, transferability, settlement, and reporting) it begins to loosen the constraints that limit market participation.

This distinction matters.

Many debates frame tokenisation as a technology-led transformation. In reality, its significance is economic. By reducing the cost of coordination and the time capital remains idle, tokenisation shifts how markets behave under stress. Capital becomes easier to mobilise. Participation becomes less binary. Markets become more continuous rather than episodic.

The key insight is this: tokenisation does not solve real estate’s problems. It enables the market to confront them.

Used correctly, it does not replace existing actors or processes. It makes them more scalable, more connected, and more responsive to the demands of a market that has outgrown its original structure.

💡

Investor Lens:

Tools don’t change markets, systems do.

And when you trace every bottleneck in real estate back to its source, you find the same constraint repeated: the cost of movement.

Liquidity Is the Real Constraint: How capital friction shapes behaviour across the market

Once the discussion moves beyond tools and into structure, one constraint becomes impossible to ignore: liquidity.

Liquidity in real estate is often misunderstood as a secondary feature, something desirable, but not essential. In practice, it is the mechanism that determines who can participate, how long they can stay engaged, and whether capital can adapt as conditions change.

When liquidity is limited, markets do not freeze overnight. They narrow.

Capital becomes selective. Participation becomes conditional. The ability to wait, rather than the quality of the asset, starts to define outcomes. Those with flexible balance sheets, existing equity, or alternative exit options remain active. Others slowly step back, because movement becomes too costly.

This is how exclusion happens without a crash.

Illiquidity stretches timelines. It increases the penalty for being wrong, early, or small. As a result, capital concentrates around fewer actors who can absorb delays and uncertainty. The market continues to function, but renewal weakens. New participants struggle to enter, not due to lack of interest, but due to lack of mobility.

Over time, this creates a split market.

On one side are participants for whom time is optional: investors, lenders, and owners who can hold through cycles. On the other hand are those for whom time is binding, agents waiting on settlement, developers bridging cash-flow gaps, or lenders managing warehouse exposure. The same market serves them very differently.

Liquidity, in this context, is not about faster trading. It is about optionality.

When capital can move, participants can adjust. When it cannot, behaviour becomes defensive. Projects are structured around survival rather than optimisation. Decisions prioritise certainty over efficiency. Risk is avoided not because it is unattractive, but because it is unrecoverable.

This is why liquidity is not a feature layered on top of real estate markets. It is the condition that determines whether participation expands or contracts as markets grow.

Without sufficient liquidity, growth at the asset level produces rigidity at the system level. The market appears stable, yet quietly loses its ability to adapt, renew, and absorb new entrants.

💡

Investor Lens:

Illiquidity doesn’t stop markets. It stops entrants.

Hadley Heights 2 - Dubai

From Market Friction to Market Roles

Liquidity does not exist in abstraction. Its effects are felt through the people and roles that operate the market day to day. When capital moves slowly, behaviour adjusts. Incentives shift. Certain roles become compressed, while others absorb disproportionate pressure.

Nowhere is this more visible than at the edge of the transaction, where market structure meets human effort.

Real estate agents sit closest to this boundary. They experience liquidity not as a theory, but as delayed settlements, abandoned deals, and income that arrives long after the work is done. As market friction increases, their role quietly transforms, often without their consent or compensation.

Understanding how tokenisation reshapes the market therefore requires starting with agents because they are the most exposed to structural inefficiency.

Free membership in the global think tank shaping the future of real estate.

What Changes for Agents: From one-off transactions to asset lifecycles

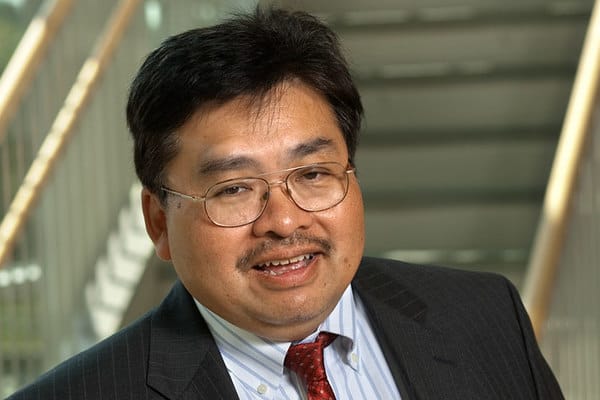

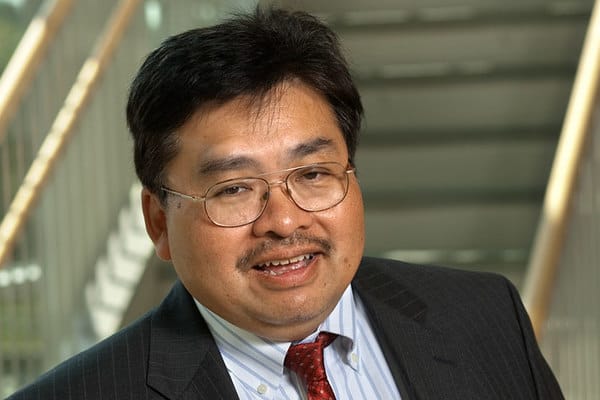

Dr Farid Zadeh Bagheri is an entrepreneur and strategist focused on redefining access in real estate through structural insight, technology, and global investment experience.

Dr Farid Zadeh Bagheri is an entrepreneur and strategist focused on redefining access in real estate through structural insight, technology, and global investment experience.